Tourism leaders in New Zealand have raised concerns about the future of the industry due to a proposed NZ$15 million reduction in government funding to promote New Zealand as a visitor destination.

James Doolan, Strategic Advisor at Fantail Advisory and Strategic Director at hotel industry body Hotel Council Aotearoa (HCA), said that New Zealand is systemically underinvesting in tourism marketing.

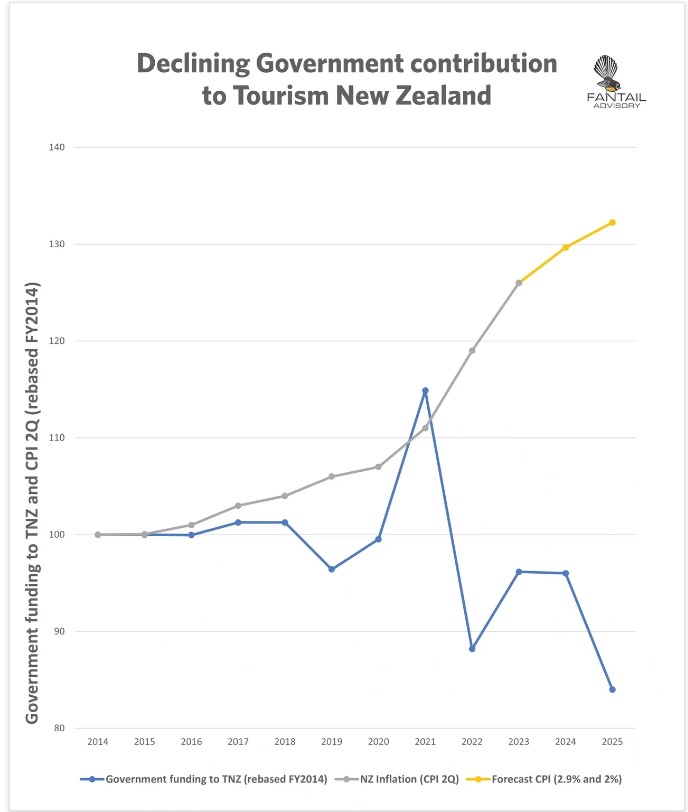

A graph produced by Fantail Advisory illustrates a decline in central government funding provided to Tourism New Zealand (TNZ) over the last decade, alongside inflation (CPI).

“In short, if the government’s recent announcement of a NZ$15 million reduction in TNZ baseline funding for next year is implemented, then it means topline annual investment into TNZ’s destination marketing will have decreased by 16.3% over 10 years,” said Doolan.

“Meanwhile, cumulative inflation over that same period is on track to reach a whopping 32%. The outcome? Less money for TNZ’s activities in a much higher-cost operating environment.

“Turning to the underlying numbers, in FY2014 central government funded TNZ to the tune of NZ$115.9 million. Keeping up with inflation only, that funding should be reaching NZ$153 million in FY2025. Instead, Minister of Finance Grant Robertson is proposing to fund only $97 million, which is an annual shortfall of $56 million or 37% below where it should be.”

Doolan pointed to a 42% increase in Tourism Australia funding between 2014 (AU$130 million) and 2024 (AU$184.5 million) as a comparison.

“International tourism is a competitive activity, and Australia has been making a lot more good moves than New Zealand in the last decade,” he said.

The tourism leader said a decision to deliberately defund international tourism marketing at this time is “mind-boggling”.

“New Zealand’s visitor economy in 2025 will be much larger than it was in 2014, even after the massive damage caused by Covid and closed borders,” Doolan added.

“The minimum wage has risen 60% across the same period, and population has increased by 15.6%. The period under analysis includes 865 days of Covid-related closed borders, during which time topline annual revenue from international tourism fell by 91.6% (NZ$17.6 billion to NZ$1.5 billion).

“Profitability for tourism businesses is still below pre-Covid levels, which means New Zealand cannot afford to put the brake on its international marketing activity.”

In addition to the proposed cuts at national level, earlier this year New Zealand’s largest city Auckland made significant cuts to destination marketing and event attraction while its controversial hotel ‘bed tax’ was approved by the Supreme Court.

With the October 14 General Election looming, Doolan said policymakers must demonstrate “a genuine desire” to fix the issue before long-term damage is done to what was once New Zealand’s largest export industry.

“Tourism is an export industry that creates meaningful employment and drives regional transformation – it can help New Zealand rise up in response to our current economic challenges, including the stubborn trade deficit and stagnant growth,” he said.

“Serious conversations need to be had very quickly between all stakeholders, or else New Zealand’s once-stellar tourism industry will continue to lurch from crisis to crisis. In years to come, we cannot pretend we didn’t see it coming.”