More than 400 accommodation businesses have closed shop in the five years to the end of June 2018, with the growth in the unregulated sharing economy singled out as a key cause, new data released this week reveals.

According to the ‘Tourism Businesses in Australia’ study from Tourism Research Australia (TRA), the accommodation sector appears it is becoming a victim of the overall success of the wider industry, with a reduction in the number of businesses despite increased tourism activity.

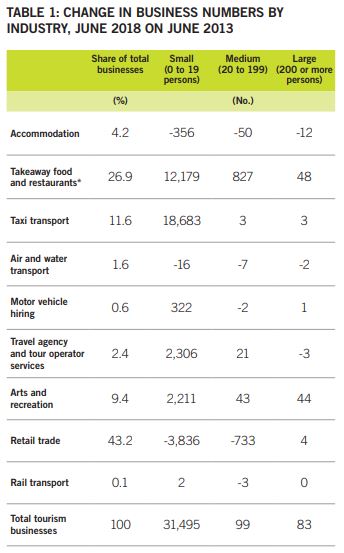

In the five year period from July 1, 2013 to June 30, 2018 inclusive, the number of businesses classified as accommodation decreased by 418. Broken down, this figure comprised of 12 large businesses with 200 employees or more, 50 medium-sized operations with headcounts of between 20 and 199 and a sobering 356 businesses with between zero and 19 employees. The study shines a different spotlight on the sharing economy following the release earlier this month of the 2018-19 Australian Accommodation Monitor (AAM).

The accommodation sector made up 4.2% of Australia’s overall tourism and tourism-related scope, which included businesses both directly affecting the sector such as air and water transport companies, tour operators and hotels/motels (see Table 1).

Tellingly, the TRA report highlighted the growth of the sharing economy and specifically named Airbnb as having been a catalyst for the reduction in accommodation businesses over the five-year period.

“With platforms such as Airbnb potentially affecting the viability of traditional accommodation businesses, it is possible that the sharing economy is responsible, in some part, for the decrease in business counts,” the report reads.

However, the report clarifies that platforms such as Airbnb allow individuals “to provide accommodation services without registering as a business, which means these additional services are not included in national business counts.”

Businesses indirectly affecting the sector such as takeaway food outlets, general retailers and taxi transport licensees were included in the study. These indirect sectors experienced massive growth in the five-year period, with more than 18,600 new taxi licenses granted and more than 12,100 takeaway food outlets commencing trade, largely in response to the boom in food delivery services such as Uber Eats and Deliveroo. Conversely, retail trade took a huge hit, with nearly 4,000 shops pulling down the shutters for good as online shopping soared in popularity.

According to the study, tourism businesses make up one-eighth of Australia’s national economy and 13% of Australia’s total business count. Other stats showed population growth contributed to 10% growth in average turnover of medium and large tourism businesses in Australia, while small operations recorded a significantly smaller 0.9% growth in the same metric.

The overwhelming majority of tourism businesses (95%) were small operations ranging from zero to 19 employees, with the growth in non-employing businesses skyrocketing by 20.9% over the five year survey window.